Loans

Learn more about IOU Financial, who we are, details on loans and other services we provide.

IOU Financial operates an internet-based lending platform aimed at owner-operated businesses with daily sales. IOU Financial’s platform accepts applications from businesses like (cafes, restaurants, retail stores, dry cleaners, medical offices, franchisees, etc.) to apply for 6, 9, 12, 15, 18, 24 or 36 month loans that range between US$15,000 and US$1,500,000 and that are repaid daily, weekly, bi-weekly, or monthly over the term of the loan directly out of the business’ bank account.

Our lending activities are subject to federal, state and local regulation. We must comply with applicable state laws, including state lending laws and licensing and disclosure requirements. IOU Financial is licensed and/or registered with all states in which we conduct business.

IOU Financial reserves the right to service all business loans originated through its lending platform or send them to an outside agency.

No, IOU Financial is not a merchant cash advance company. Our loans are true business loans with fixed terms and payments.

IOU Financial Offers loans from $15,000 to $1,500,000 depending on the monthly cash flow of your business, and your business risk score.

IOU Financial charges an origination fee to borrowers. The origination fee is a percentage of the loan amount and will be added to your loan amount. Your gross loan amount will include your origination fees and do NOT have to be paid upfront.

IOU Financial offers fixed interest loans. IOU Financial determines the amount of interest and adds it to the net loan amount. Each payment amount is exactly the same for the duration of the term with the exception of the last payment, which in most cases is slightly less than all other payments.

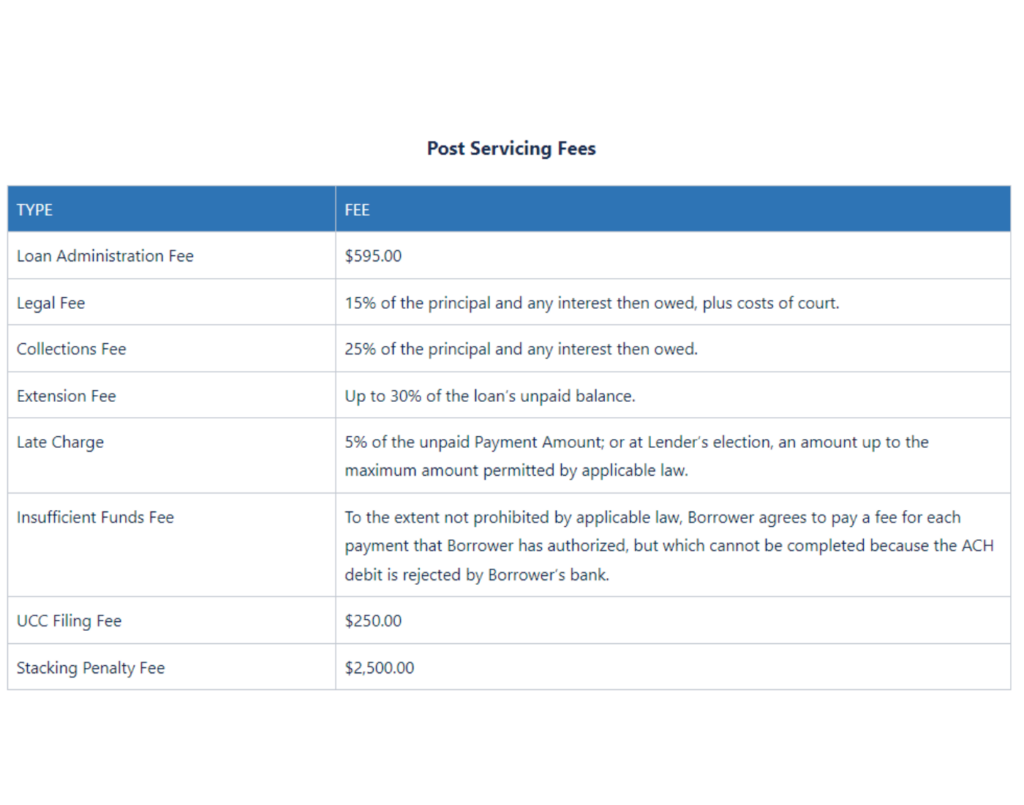

For a breakdown of the fees associated with IOU Financial’s Administrative and Servicing costs, please refer to this list.

From 2008 to June 2015 IOU Financial operated as IOU Central in the United States. As of 6/1/2015 the US subsidiary took the name of its Canadian parent, IOU Financial. IOU Financial operates offices in Montreal, Canada (its Headquarters) and Atlanta, GA (Operations Center). IOU Central remains the legal business name on all lending and legal documents in the United States. IOU Financial Canada Inc. is the legal business name on all lending and legal documents in Canada.

Privacy & Security

Rest easy knowing IOU has your security taken care of.

IOU Financial does not sell, rent or trade your personal information to third parties or marketing firms for their promotional purposes. We do send communications periodically to inform you of the status of transactions or events related to your use of the IOU Financial web site.

More information as it pertains to personal information we collect and the use of personal information is defined in our Privacy Policy.

IOU Financial goes through great lengths to make sure your information is secure. Here’s how:

- 128-bit secure sockets layer (SSL) Technology:

To access your account you must use a browser that supports 128-bit encryption. This is one of the best commercial methods available. - Screen name and password:

Your screen name and password are unique to your account. You should change your password regularly. No one at IOU Financial will ever ask you for your password in order to service your account. - Firewalls:

The computers that run our site are protected by firewalls that prevent unauthorized access to the network. - Session Timeouts:

Your IOU Financial session will automatically end if you don’t perform any transactions for 15 minutes. To resume your session, you will need to sign in again with your username and password. - SMS Verification:

For extra security – you can enter your mobile number in the “Account Profile” Security section – for a text mobile PIN verification each time you log in – Text rates apply and IOU Financial is not responsible for your Texting charges.

We verify and validate identity by matching a multitude of database information including but not limited to: Credit rating agency databases, SOS databases, Banking institution databases, social media databases and the US Department of Treasury OFAC lists. Prior to closing we record a closing call and walk the owner through an out of wallet identification validation process.

If IOU Financial suspects that there is a loan with a borrower who has committed identity theft, we will work with law enforcement authorities to track down and prosecute these identity thieves. We have worked with State Postal Inspectors, Local Police and the White Color Crime Division of the FBI to help prosecute fraudsters and identify thieves.